- Markets

SELF-MANAGED INVESTING

- Platforms

Find a platform that fits your trading and investment needs

- Investing

- Accounts

ACCOUNT TYPES

Discover our professional-grade platform, built for advanced traders

Recategorise as an Elective Joint to waive regulatory

protections designed for less experienced traders. - Offers

- About

- Markets

SELF-MANAGED INVESTING

- Platforms

Find a platform that fits your trading and investment needs

- Investing

- Accounts

ACCOUNT TYPES

Discover our professional-grade platform, built for advanced traders

Recategorise as an Elective Joint to waive regulatory

protections designed for less experienced traders. - Offers

- About

Managed Portfolios

Free your time. Have experts navigate markets and manage your investments.

Why invest with Citation Invest?

Simple and smart

Get set up quickly online, then we’ll do the hard work for you.

Managed by experts

We manage your investments based on world class industry expertise.

Cost effective

Pay just a fraction of the cost of traditional wealth managers.

No lock-in period

If your circumstances change you can withdraw at any time.

What are managed portfolios?

A managed portfolio is a collection of investments that are selected and automatically adjusted for you according to market opportunities.

Each portfolio caters for a different risk appetite, ranging from low to high, and follows an investment strategy suited to your goals and profile.

You’ll have full transparency and control: you can monitor your investments 24 hours a day through our platform, and withdraw at any time for no extra cost.

Portfolios built by experts

When you invest in a Citation Invest Invest portfolio, you can rest assured that your money is in the best possible hands.

We’ve partnered with world-leading asset managers, including BlackRock and Morningstar, to create a range of low-cost, institutional-quality portfolios.

They are automatically rebalanced to adapt to changing market conditions, and continually target the highest returns for the risk-level taken.

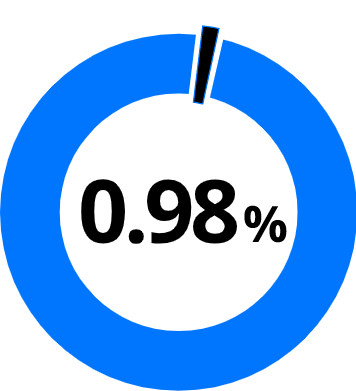

Keep your costs under control

Without any unnecessary charges, we help you keep more of your returns.

Total expected cost p.a. from:

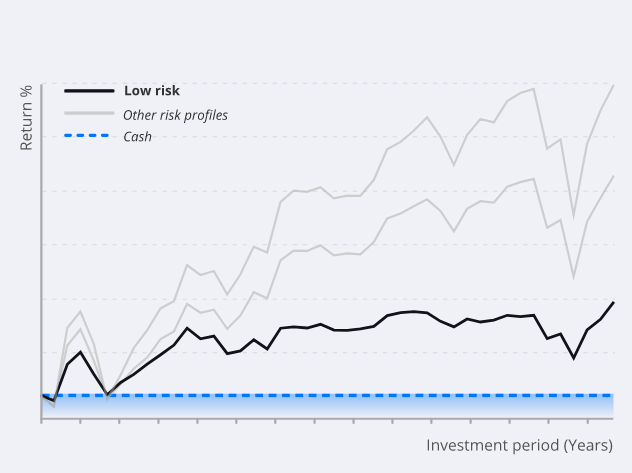

What is the risk and expected return?

Risk and return come hand-in-hand. The more return you target, the more risk you must take.

Performance is expected to be less than stock markets, but also more stable. In an extreme scenario stock markets could lose 20% or more, whilst Medium risk portfolios are expected to lose closer to 10% to 15%.

Performance of High risk portfolios is expected to be similar to stock market performance. However, in an extreme scenario stock markets could lose 20% or more and is therefore considered high risk investing.

Looking for something more speculative

With Trading strategies your money is traded to find short term opportunities in financial markets

Frequently asked questions

If you don’t have a Citation Invest account, create one and add funds, considering the minimum investment amount required for the portfolio you’re interested in. Then follow these steps:

- Open the platform and click the ‘Citation Invest’ tab

- Take the suitability test to determine your risk profile and the managed portfolios that are suitable for you

- Browse the portfolio options and choose one by clicking “Invest”

- Add the amount you’d like to invest and confirm your choices

If you already have a Citation Invest account, just access the ‘Citation Invest tab’ in your platform and follow the steps above. The first time you invest in a managed portfolio you’ll have to take the suitability test, which is different from the appropriateness test (for self-directed investing).

This is a set of questions that will determine your risk profile and, based on it, the portfolio options that are suitable for you. Based on your answers, you may receive a risk profile that doesn’t match your initial portfolio choice, which means you won’t be able to invest in that portfolio. If this is the case, please check that your answers are accurate and contact us if you need clarification.

The suitability test is mandatory. It is the portfolio manager’s responsibility to ensure that the investment made on your behalf is suitable for you – and the suitability questions are the primary method for such determination.

Fees depend on the managed portfolio you choose to invest in. Please visit the individual portfolio pages above to check specific fees.

As with all investing, there is a relationship between the amount of risk you take and the level of returns you could receive (both positively and negatively). The risk profiles of managed portfolios indicate the potential severity of a loss (of value) during a negative period. As a reference, investing into stocks is considered high risk and during a bad period the stock market could lose around 20%, based on historic events.

Low risk portfolios are expected to experience much less fluctuation (of value) than stock markets;

Medium risk portfolios are expected to experience notably lower fluctuation (of value) than stock markets;

High risk portfolios are expected to experience similar fluctuation (of value) to stock markets;

Very high risk portfolios are expected to experience price fluctuation above stock markets.

There is no minimum investment period and you can exit at any time for free. However, it’s important to remember that our managed portfolios are designed for long-term investing and only recommend them if you intend to invest for several years.

Start investing in minutes

1

Open an account

If you’re new to Citation Invest, take a few minutes to submit your application.

2

Choose your portfolio

Select a portfolio suited to your goals and risk appetite, then complete our short profile questionnaire.

3

Invest

Confirm your managed portfolio and invest. We will place all the investments for you, in your account.

Talk to our support team

Speak to one of our specialists today and we’ll help you get started.

Trusted for more than 25 years

Fully regulated

We adhere to the strictest regulatory standards, and are fully licensed and regulated in 15 jurisdictions across Europe, the Middle East and Asia.

Financial strength

We’re a financially stable company with a robust balance sheet. We serve clients in 170 countries, hold 95 bn USD in AUM and process 1m transactions daily.

Multi-award winner

We’ve been consistently recognised by our industry and have won the highest accolades for our products, platform and service.

Ready to get started?

Citation Invest Reviews

Leverage 1:30

Min. Deposit: 1USD

Platforms: MT4, MT5, Citation Invest Trader

CopyTrade

Regulation: CySEC, IFSC, FCSA, ASIC

HQ: Belize and Cyprus

Found in: 2009

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76.46% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please refer to our Risk Acknowledgement and Disclosure.

Citation Invest Broker Licenses

Tradestone Limited -authorized by CySEC (Cyprus) registration no. 353534

Intelligent Financial Markets Pty Ltd- regulated by the ASIC (Australia) license number 426359.

Citation Invest Markets Inc. -authorized by IFSC (Belize) registration no. 119717

TRADE STONE SA (PTY) LTD -authorized by FSCA (South Africa) license no. 0885

Copyright © 2009 – 2022 Citation Invest. All rights reserved